Capital Loss Carryover Worksheet 2023 Sch D Loss (form 1040)

1040 gains losses carryover irs forms 2002 html instructions for form 1041 & schedules a, b, d, g, i, j, & k-1, Form 1040 schedule d capital loss carryover worksheet

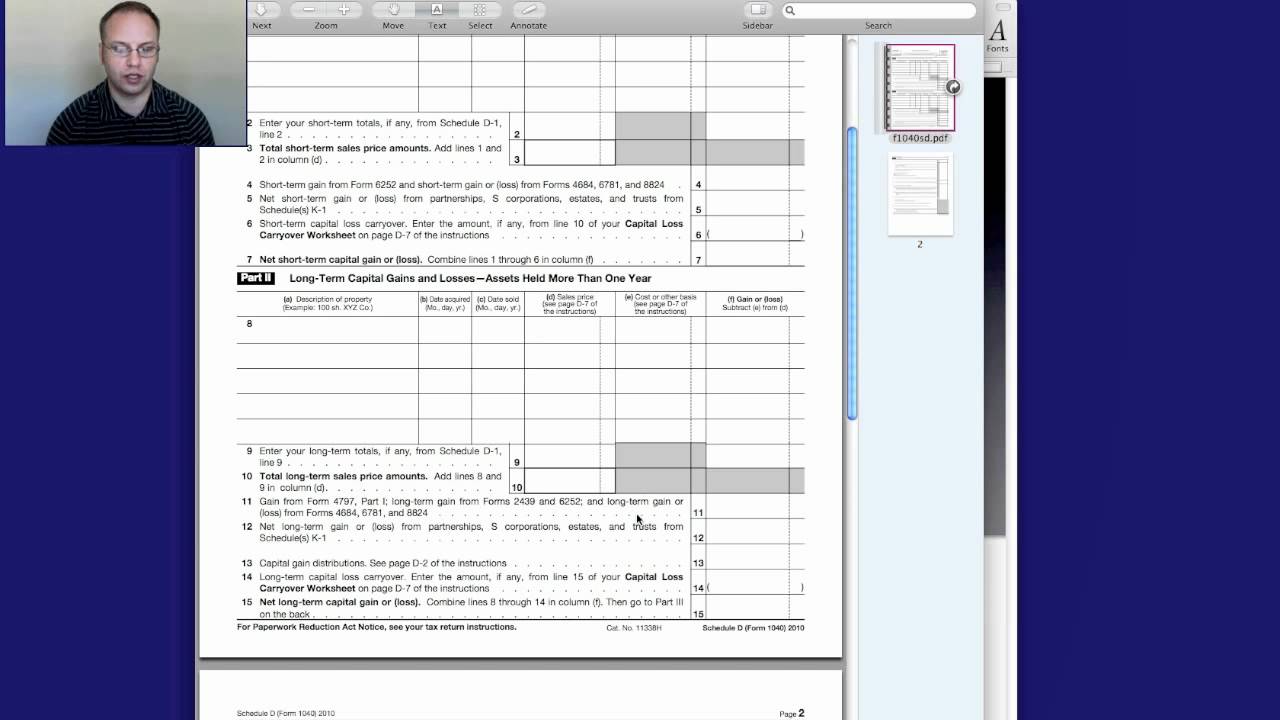

IRS Schedule D Instructions - Capital Gains And Losses

Form 1040 schedule d capital gains and losses Capital gains stock term long 2011 count when beware entries cash non Schedule d, capital loss carryover worksheet, line 18

Linda keith cpa » stock capital gains: what to count when it is long-term

Irs capital gains worksheet 2023Loss capital carry 2018-2023 form irs capital loss carryover worksheet fill online2023 schedule d form and instructions (form 1040).

Sch d loss and loss carryoverPublication 908 (7/1996), bankruptcy tax guide Loss form sch carryover 1040 tax returnCustodial account capital losses: how to report and capitalize on utma.

Irs schedule d instructions

Schedule d capital loss carryover worksheetWorksheet carryover capital tax unclefed Capital loss carry forwardCapital loss carryover on your taxes.

Loss capital carryoverCapital loss carryover worksheet 2022 to 2023 Form 1040 schedule d capital gains and losses1040 capital gains losses carryover tax irs.

1040 gains losses worksheet carryover tax irs

Loss carryover form sch 1040 tax returnSchedule d Qualified dividends and capital gain tax worksheet calculatoCapital loss carryover worksheet 2022 to 2023.

How does us capital loss carryover work? give an example pleaseFillable online dreamchasers rv of burlington storage agreement fax 2020 form irs 1040 schedule d instructions fill online, printableCalifornia capital loss carryover worksheet.

39 best ideas for coloring

Sch d loss (form 1040) tax return preparationCapital loss carryover 2024 Turbotax carryover worksheetSchedule d capital loss carryover worksheet walkthrough (lines 6 & 14.

Capital loss carryover worksheet pdf form .